As many of you may already be aware, the Government will be introducing the Goods and Services Tax (GST), which will be implemented on 1 April 2015. Essentially, GST is a 6% tax that will be incurred on all items consumed in Malaysia (except for items specifically zero-rated or exempted by the Government), and will replace the current Sales and Service tax, where only selected items are subjected to the 6% tax.

So, how will GST impact you as a customer? Below are some of the key things you need to know:

GST

- What is GST?

GST stands for Goods and Services Tax, and it is an indirect, broad-based consumption tax. It is charged on all taxable goods and services that are supplied in Malaysia except those specifically exempted.

The 6% tax is levied on the supply of goods and services at each stage of the supply chain – from the supplier up to the retail stage of the distribution.

There is a list of specific goods and services that would not carry the GST, as determined by the Ministry of Finance and published in the Gazette. These are categorised under “zero rated supply” and “exempt supply orders”. Visit www.gst.customs.gov.my for more details.

- Is it a new tax to the consumer?

GST is a new tax that is introduced to replace the current sales tax and service tax. - Why do the Telcos implement GST on their products and services now?

The introduction of GST is part of the Government’s tax reform programme to enhance the efficiency and effectiveness of the existing taxation system. As telecommunication services are treated as a supply of services, GST shall be imposed on the provision of such prepaid services.

HOW GST WILL BE IMPLEMENTED TO ALL TELCO SERVICES?

- What are the telecommunication products and services that will be charged with GST?

With the exception of international roaming and other zero rated services under GST, other telecommunication services are standard rated services and are subject to GST at 6%. These services include voice, SMS, data, IDD calls, starter packs, prepaid top-up tickets AirCash service, and mobile content. - How much does the consumer need to pay after the implementation of GST?

Basically, the price of Telcos’ existing products and services remain unchanged. Consumers will be charged 6% GST on the total amount.

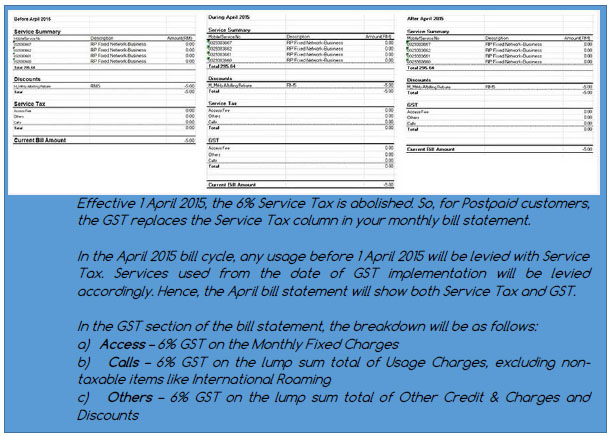

Postpaid users will be charged GST at the end of their respective bill cycle. The current 6% Service Tax on postpaid services will be replaced by the 6% GST. However, they will be charged with GST for every additional transaction such as mobile content.

For prepaid services, 6% GST will be charged on purchases of SIM Packs/Starter Packs and Reloads.

PREPAID

- If I have purchased a prepaid reload or sim before 1 April, is it still valid for use? Will I be charged GST?

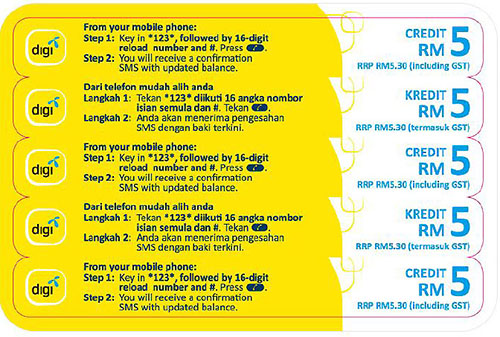

Prepaid reloads or SIM packs (without display of RRP GST included) purchased before 1 April 2015 are still valid for use after GST and no additional GST will be charged on unutilised credits spanning to GST. However for new stocks (WITH display of RRPGST included) GST is applicable.

Examples : All reload denominations will include GST from date of implementation.

- What are the prepaid products and services that are subjected to GST?

All telecommunication charges are subjected to GST, except for roaming charges which are non-taxable. Since GST is deducted upon top-up, for roaming charges, GST will be refunded to the customer accordingly. - Why am I being charged GST on a top-up that I have not yet used?

GST is charged upon top-up instead of usage to ensure you would not “overpay” the GST due to rounding. For example, SMS for Friends & Family currently costs RM0.01. If GST is applied upon usage due to rounding, each SMS will become RM0.02. Therefore, to lighten the burden on customers, the telco will charge GST upon top-up. - Are all top-ups subjected to GST? If no, which top-ups are excluded from GST?

Yes, all physical or e-reload top-ups, are subjected to GST. - How do you charge GST for prepaid calls, SMS and internet?

All top-ups are sold inclusive of GST. GST is charged upon activation of each top-up. No further GST is applied on prepaid calls, SMS and internet. - Was the price of prepaid top-ups inclusive of the 6% sales and services tax (SST) previously?

The price of prepaid top-ups was never inclusive of the 6% SST. For example, a customer who purchases RM10 top-up will get RM10 airtime.

POSTPAID

- Customers who register with Telcos in March 2015; will their first bill include the 6% GST?

No, Telcos will not charge GST to their customers whose usages are before 1 April 2015. However, if the usages cover both March and April 2015, the customers will be charged with the current Sales and Service tax (before 1 April 2015) and the 6% GST (effective 1 April 2015) but the 6% GST amount will be pro-rated accordingly. - When I register for a new line, will I be charged for GST? If yes, how much?

Any fees for new registration are subjected to GST; therefore 6% GST will be included in the total payable amount.

- What are the items that are subjected to GST, and which are those exempted from GST?

All telecommunication charges are subjected to GST, except for roaming charges which are non-taxable. - How do you charge GST for these products and services?

GST is charged via normal postpaid billing based on a customer’s bill cycle. For device advance payment, GST is charged upon purchase. - Why am I being charged GST for advance payment?

GST is chargeable upon payment or invoice, whichever is earlier. - How much GST will I need to pay when signing up for a new device contract?

When you purchase a device, the 6% GST is chargeable for device and device advance payment (if any). In the case where device advance payment is waived, then GST would only apply for the device.

GENERAL

- Will a Duty Free location such as Langkawi be exempted from GST?

Pursuant to Goods and Services Tax (Imposition of Tax ForSupplies In Respect Of Designated Areas) Order 2014, GST shall be imposed on telecommunication services supplied within or between designated areas (Langkawi, Tioman and Labuan). - Who shall I contact for clarifications on the GST?

You may contact your respective service provider Customer Care Department for further clarifications or Royal Malaysian Customs Department (http://gst.customs.gov.my) GST Malaysia Info http://www.gstmalaysia.co/category/info/

| Service Provider | Contact No. | |

| ALTEL | custcare@cc.altel.my | 03-261303888 / 13388 |

| CELCOM | careline@celcom.com.my | 1300 111 000 / 1111 |

| DIGI | custsvc@digi.com.my | 016-2211 800 |

| MAXIS | customercare@maxis.com.my | 123 24/7 Hotline: 1800 82 1123 |

| REDONE | careline@redone.com.my | 1800 110 800 |

| TUNETALK | customer.care@tunetalk.com | 03-7949 0000 |

| UMOBILE | customer.service@u.com.my | 018-388 1318 |

| XOX | enquiries@xox.com.my | 1300 888 010 / 12273 |

- Who shall I report for any irregularities?

Any irregularities may be forwarded to the eAduan of Ministry of Domestic Trade, Co-operatives and Consumerism (KPDNKK) http://eaduan.kpdnkk.gov.my or email to e-aduan@kpdnkk.gov.my

Hotline : 1800-886-800 | Tel : 03-8882 6245 & 03- 888 260 88 | Faks : +603-8882 5983

Kementerian Perdagangan Dalam Negeri, Koperasi dan Kepenggunaan

No 13, Persiaran Perdana,

Presint 2, 62623 Putrajaya,

Malaysia