Your smartphone does more than just make calls and let you catch up on what’s happening on social media. If you are a fairly savvy user, you will have taken advantage of the convenience offered by many banking institutions and online retailers today and use your smartphone to pay your bills, order groceries and conduct other business online. All this financial activity makes your phone a temptingly lucrative target for criminals.

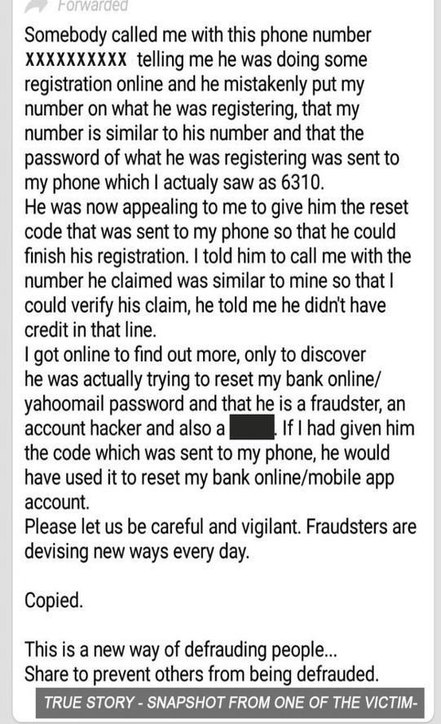

Seeing as stealing a phone these days is rather passé, more devious criminals have come up with a more covert way to make off with your money without even nicking your phone in the first place. Enter the new scam that can potentially wipe out your savings in a matter of minutes – smartphone account fraud.

WHAT’S SMARTPHONE ACCOUNT FRAUD?

Smartphone account fraud occurs when criminals attempt to gain access to your smartphone account by using falsified documents and then attempt to change your SIM card to a new one that they take possession of, effectively locking you out of the service. Many victims have no inkling of it happening until they suddenly lose service on their phones and by then it may be too late.

For that brief window of time, calls, emails, and other details are shunted to the new SIM card, potentially gaining criminals access to your email, banking accounts, social media, and more. The main reason criminals do this is to bypass two-factor authentication security protocols.

Two-factor authentication is a means of enhanced security where service providers send a unique one-time code via email or an SMS to your smartphone which you then use to login to conduct a transaction. By hijacking your phone number, criminals can bypass two-factor authentication. They can transfer money out of your account, set it up for more fraud attempts in the future for other people in your network, apply for loans or more credit cards, buy expensive stuff off, or worse.

HOW DO YOU PREVENT SMARTPHONE ACCOUNT FRAUD?

Smartphone account fraud is a very real danger as it not only risks you losing money but also making you liable for other forms of fraud. Here are several measures to ensure you don’t fall victim:

Only download apps from the official app store to minimize the chances of malware. This means Google Play for Android and the Apple App Store for iOS devices.

Only download apps from the official app store to minimize the chances of malware. This means Google Play for Android and the Apple App Store for iOS devices. Do not conduct banking, shopping, or other sensitive transactions when using free public Wi-Fi as criminals can potentially snoop out your passwords.

Do not conduct banking, shopping, or other sensitive transactions when using free public Wi-Fi as criminals can potentially snoop out your passwords. Be cautious when you receive emails or phone calls asking you to provide your account details or asking you to click on a link or attachment; websites and emails can be faked in a convincing fashion. Go to their official website and clarify first.

Be cautious when you receive emails or phone calls asking you to provide your account details or asking you to click on a link or attachment; websites and emails can be faked in a convincing fashion. Go to their official website and clarify first. If anyone on your network starts behaving oddly like messaging you for your personal details or money, beware! Scammers may be mimicking your friend with a spoofed account to trick data out of you.

If anyone on your network starts behaving oddly like messaging you for your personal details or money, beware! Scammers may be mimicking your friend with a spoofed account to trick data out of you. Beware of people calling and claiming to be bank or authority figures asking for personal account details. Legitimate authorities have no need to ask you for them.

Beware of people calling and claiming to be bank or authority figures asking for personal account details. Legitimate authorities have no need to ask you for them. Before logging onto any website that requires personal data, check to make sure that the site has a closed lock icon in the corner before proceeding.

Before logging onto any website that requires personal data, check to make sure that the site has a closed lock icon in the corner before proceeding. Notify your bank to inform you if any transactions out of the ordinary occur. If your phone goes out of service or if you encounter any oddity in billing, contact your provider’s customer service immediately.

Notify your bank to inform you if any transactions out of the ordinary occur. If your phone goes out of service or if you encounter any oddity in billing, contact your provider’s customer service immediately. Invest in anti-spyware and antivirus security for your PC and phone. Keep them updated to be ahead of malware attempting to infiltrate your devices.

Invest in anti-spyware and antivirus security for your PC and phone. Keep them updated to be ahead of malware attempting to infiltrate your devices.

Source: SHOUT H1, 2018

#CFMmalaysia

#GetSmarterWithConsumerinfo

#YourRightsOurPriority